- ECONOMIC IMPACT -

Latest update: 19 January

Since Russia launched a full-scale military invasion of Ukraine on 24 February, data from the United Nations Refugee Agency indicates that eight million refugees from Ukraine have been recorded across Europe.

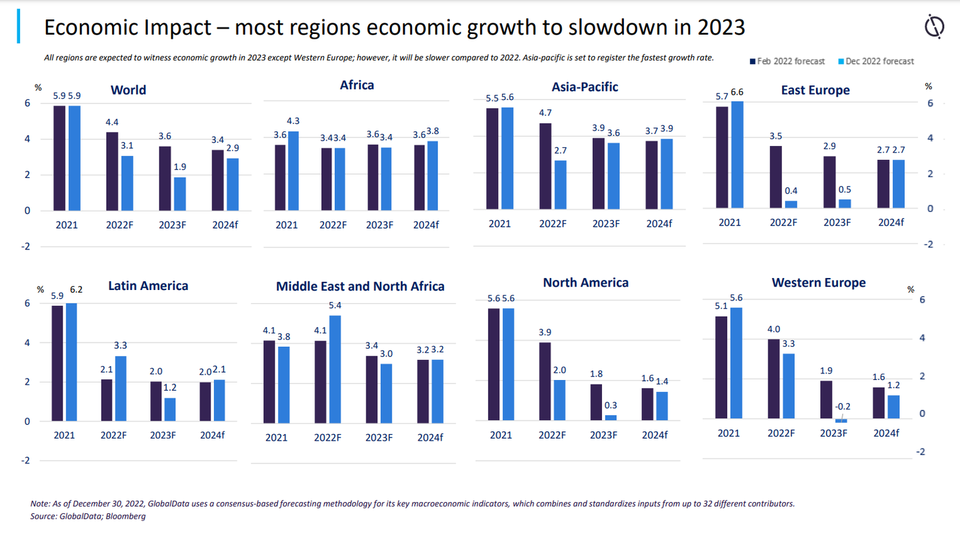

GlobalData forecasts that the world economy will grow at a slower pace of 1.9% in 2023, following a 3.1% growth in 2022. Global inflation is projected to ease to 5% in 2023 from 8.4% in the previous year.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 19 January

Revenue impact

With no end to the conflict in sight, fuel prices will continue to surge for

airlines. This will negatively impact their bottom lines unless they pass the entire additional cost on to the traveller, which could reduce demand in an industry where consumers can easily find substitute services.

For example, US Passenger Airlines' fuel cost per available seat mile increased from $0.31 to $0.47, a year-on-year increase of 51.6%. American Airlines is forecasting fuel to increase by $3.92 to $3.97 per gallon, increasing $0.33 per gallon from the previous estimate of $3.59 to $3.64. Increasing fuel costs means that airlines cannot optimise performance and their post-Covid-19 recovery will be extended.

The conflict has also raised concerns surrounding potential titanium supply shortages, with titanium a key metal used in the manufacturing of aircraft. Ukraine and Russia are among the leading producers of titanium, and the ongoing conflict could impact supply in the near term causing a knock-on effect on airlines.

The ongoing conflict has impacted supply chains, causing a knock-on effect on airlines. Russia was the largest supplier, producing half of the world’s titanium used in aerospace before 2022 and providing 40% of Boeing’s, 60% of Airbus’, and 100% of Embraer’s titanium.

Key Travel And Tourism developments

SANCTIONS

Under mounting pressure from Western sanctions, Aeroflot, Rossiya Airlines, Ural Airlines, and Russian Railways have seen their revenue cut dramatically. Aeroflot, Russia's flagship airline, is now planning to raise up to $3bn in an emergency share issue. Passenger numbers for Aeroflot were down 8.2% YoY in the first nine months of 2022.

Egypt is now looking to capitalise on a lack of outbound options for Russian travellers, created by sanctions. In previous years, tourists from Russia and Ukraine have accounted for up to 40% of beach holidaymakers in Egypt, according to the Ministry of Tourism and the Egyptian Chamber of Tourist Establishments.

According to the Russian tour agency Travelata, Egypt was in the top five tourist destinations for Russian tourists for the Summer of 2022. In October Egypt shelved plans to apply the Russian MIR payment card system in its resorts and hotels amid worries about possible US sanctions.