- ECONOMIC IMPACT -

Latest update: 19 May

The Conference Board forecast that the US economy will grow by 2.3% in 2022 and 2.1% in 2023. It also projected 2.1% growth in Q2 2022 on a quarterly basis.

Indonesia's economy grew by 5% on an annual basis in Q1 2022, driven by a rise in commodity prices and relaxation of Covid-19 restrictions.

5.1%

The unemployment rate in OECD nations stood at 5.1% in March 2022, a marginal decline from the 5.2% in the previous month.

6.8%

The unemployment rate in the Euro area stood at 6.8% in March 2022, a decline from 6.9% in February 2022, according to Eurostat.

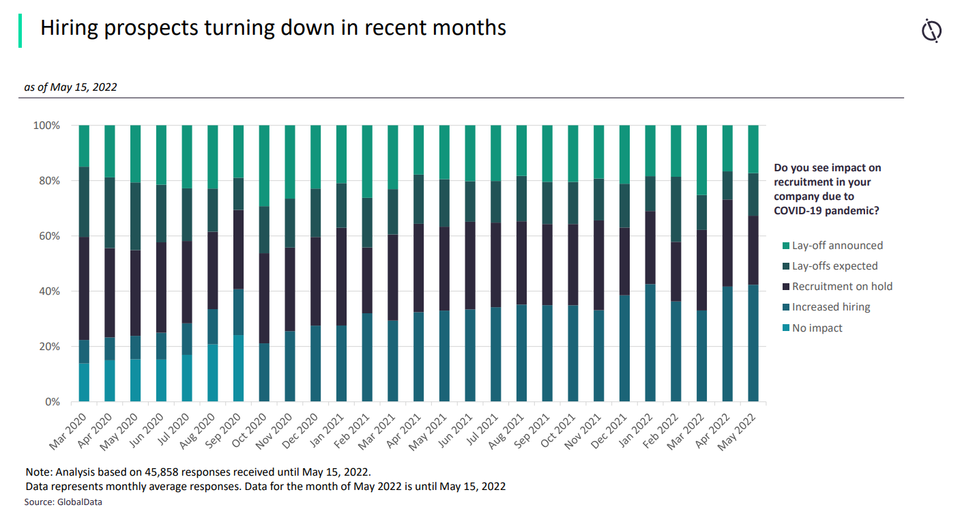

Impact of Covid-19 on EMPLOYMENT OUTLOOK

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 19 May

2022 is proving to be a pivotal year in the travel and tourism industry. Most major travel restrictions have been withdrawn, allowing international passengers to move freely.

However, there is still some negative sentiment within the industry, with some travellers concerned about the spread of the virus. Furthermore, the increased cost of living and inflation is set to impact consumer behaviour significantly.

Destinations will continue to review the spread of Covid-19, although many governments are learning to adapt and manage the virus without the need for social distancing, lockdowns, and travel restrictions.

Therefore, it is unlikely that the industry will see the same level of travel restrictions as in 2020-21. However, a handful of destinations are still operating a ‘No-Covid-19’ strategy.

While Covid-19 continues to threaten the travel industry, the concern is now switching to the economic issues brought on by the pandemic. Inflation and the increased cost of energy are very real issues impacting prices and disposable income on a global scale.

As tourism is not an essential good or service, many 'would-be' tourists could drop their travel plans altogether this year, impacting the speed of recovery.

Domestic tourism remains an area of intense focus and has led to substantial price surges in some markets. However, travel intermediaries are engaging in aggressive marketing towards international travel, with some advertising for as late as 2023.

Furthermore, some intermediaries and low-cost airlines are reporting similar capacity to 2019, which is an encouraging sign.