Q&A | FINANCE

Cashing in on the new normal:

how can airports diversify revenue?

Airport leaders have spoken up recently about the need to ‘diversify revenue’ and build ‘airport cities’ capable of future-proofing operations and revenue. Frances Marcellin spoke to Pieter van der Horst of Netherlands Airport Consultants and co-author of report ‘How Real Estate Can Help Airports Build Resilient Business’ to find out more about the benefits of airport cities and how real estate can strengthen an airport’s revenue stream and reduce its risk.

The Covid-19 pandemic has devastated airport revenues. Airport Council International’s most recent economic report published in August this year shows a “58.4% reduction in passengers as compared to 2019” and a “60% reduction in revenues”. This, they say, will reach “an unprecedented $104.5bn reduction in revenue for 2020”.

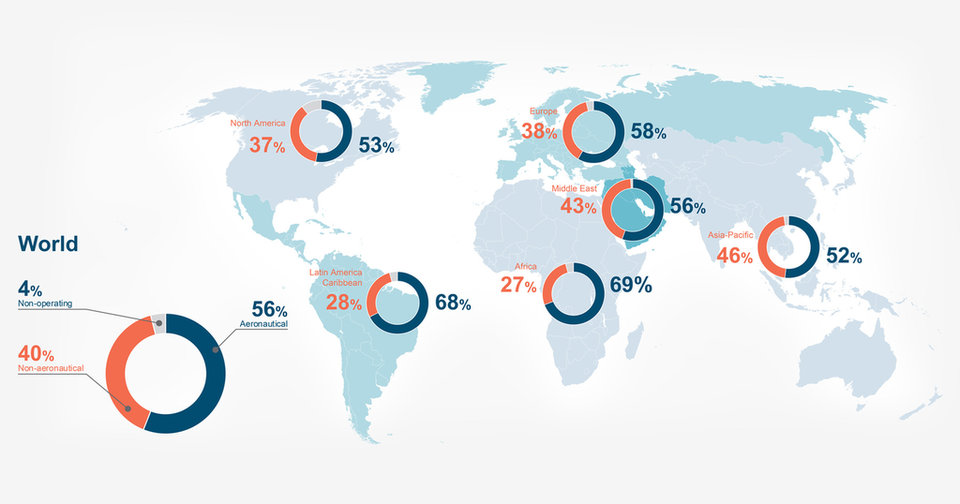

Passenger levels are not expected to return to 2019 levels before 2023 and with such a strong correlation between passenger footfall and airport revenue, the industry must find new sources of income that are independent of passenger traffic. A global economic report from the ACI for 2018 showed that 56% of revenues came from “non-aeronautical revenue”, with 40% coming from non-aeronautical sources – for example, retail and car parking deliver 30% and 20% of revenues respectively.

As the Netherlands Airport Consultants (NACO) report states, with almost 90% of airport revenues being passenger related, they are “highly sensitive to external shocks and uncertainty in terms of recovery from the Covid-19 crisis”. However, focusing on non-passenger revenues such as commercial real estate, “can counterbalance these effects to some extent while increasing airport resilience and profitability”.

Pieter van der Horst, co-author of the NACO report ‘How Real Estate Can Help Airports Build Resilient Business’, to find out more.

NACO airport city expert Pieter van der Horst. Image: NATO

Image:

Frances Marcellin: Why do you believe real estate assets are so important to airport revenue streams?

Pieter van der Hors: The fact that real estate operates on an entirely different business model to passenger-related revenues is key here. The additional “cushioning effect” that real estate brings through its constant stream of rents and leases provides some insulation from the negative financial effects of sudden, prolonged or fluctuating passenger numbers.

The pandemic is likely to be the worst downturn in aviation history, but is one positive to come out of this catastrophe that airports have been forced to focus more closely on improving their non-aeronautical revenue?

I would not position this as a “positive” that has come out of the pandemic. It is part of a wider need, however, to understand how best to absorb the shocks and mitigate the trends in diminishing revenues per passengers that are inherent in the airport business as a whole.

Currently, some 90% of airport revenues depend on passenger activity, which we have seen on various occasions can be sensitive to external events. Diversifying revenue sources is part of building that understanding and putting in place more proactive responses to these external shocks.

Having said that, our view is that airports still need to focus on a combination of non-aeronautical and non-passenger-related revenues. The big challenge for the short to medium term, however, will be in funding investments in non-passenger related revenue sources.

The white paper states that only non-passenger revenues, such as cargo-related income, are still bringing in revenues, but cites cargo as just 1% of the overall revenues. How can airports increase their share of cargo-related revenues?

Cargo real estate is indeed one area where the share can be increased since there needs to be a cargo market.

The 1% figure quoted relates to the cargo-related aeronautical revenues (and excludes landing fees). In other words, these are the aeronautical revenues generated by cargo-only movements compared to all movements. There can be more cargo-related revenues, for instance in the handling concessions or the lease of cargo facilities, whether at or around the airport.

There are only a handful of airports worldwide, such as Leipzig, Liege, Memphis, Louisville and Anchorage, that focus primarily on cargo and do so successfully. Most of these airports also happen to be hubs for large cargo airlines.

Aside from these examples, most airports have both passenger and cargo traffic, as air cargo plays an interesting role in supporting airline revenues including on passenger flights in the form of “belly cargo”.

Regional distribution of airport revenues from ACI data 2020. Image: NACO

Where else can cargo-related revenue opportunities be found?

In the lease of land and/or facilities for cargo operations, or facilities that support the entire logistics chain. Building a cargo ecosystem that supports air cargo stakeholders like airlines, handlers, forwarders, trucking companies, express service providers [and so on] also creates an attractive environment for logistics, which in turn would support cargo revenues in the long term.

Real estate revenues include office rental, shopping malls and hotel buildings. Can you give more details about which can prove most beneficial to airports?

There are many options for real estate developments around airports. In addition to those already mentioned, cargo, logistics and light industrial facilities are also seen as real estate opportunities.

There is no generically beneficial option. Those options considered most beneficial will inevitably be dependent on the individual situation, the context and the business strategy of the airports concerned. Whatever the context, all options will require tailored approaches which may well incorporate a mix or blend of multiple options.

At NACO, we have defined a four-step approach to successfully developing airport cities and airport real estate. The key is to connect the airport with the needs of the surrounding areas. This is one reason why our initial step in the process is to develop bottom-up and top-down market assessments of economic sectors within the vicinity and region of the specific airport in question. This is the most critical, first piece of the airport city and real estate development puzzle.

What factors are important for an airport to become an airport city?

Connectivity, routes served and landside connections are all key factors. In addition to this, economic indicators, governance structures and land use all play an essential role in the potential success of airport cities.

One common misconception is that airport cities are only feasible for large airports. But in reality, the airport city concepts are tailored to the size and role of the airport within its regional ecosystem.

Which European airports, in your opinion, are the best examples of airport cities and why?

Amsterdam Schiphol Airport, Munich International Airport, Helsinki Vantaa and Vienna International Airport are among some of the best examples of airport cities in Europe. As you might expect, this is not just a function of the location of the city itself. The extensive (and necessary) connections, stakeholder management, and cooperation with governmental and other bodies beyond the airport city all contribute to this.

Schiphol Central Business District, the heart of the airport city. Image: NACO

Airport hotels are dependent on passengers. Even though it is considered a “non-passenger” revenue stream, can you expand more on the risk level involved in this type of real estate venture should a similar downturn occur?

The first instances of hotels going bankrupt as a result of the current pandemic are now beginning to emerge. In the Netherlands, two hotels located relatively close to Schiphol Amsterdam Airport have already gone bankrupt. These are just two examples, but it took four to five months for the bankruptcies to take effect.

Within the first two months of Covid-19 being declared a pandemic, the hotel industry had already initiated discussions on reduced rental rates with building owners. This would allow for lease payments to the airport to continue but at a lower rate.

What this shows, of course, is that management contracts can be risky. It also shows that even building and land leases will lead eventually to diminishing incomes for airports over time.

Management contracts would be impacted immediately should another Covid-19-type pandemic occur and that impact would most likely be significant. Put plainly, 90% passenger reduction results in 90% less income for the hotel and therefore for the airport. This makes management contracts one of the riskiest options.