Covid-19

Chinese airlines suffer significant losses amid Covid-19 restrictions

Once the world’s largest outbound travel market, China is not showing any signs of relaxing its severe border measures in the short-term.

Bucking the recovery trend seen by carriers elsewhere, Chinese airlines struggled during the first half of 2022 under the country’s rigid zero-Covid-19 policy. Rising fuel costs and tensions between China and the US are also compounding woes.

Amid declining concern, the rest of the world has moved on to living with Covid-19. However, China is persisting with trying to stamp out the virus. Its borders have been largely sealed throughout the pandemic, leading to a collapse in international flights.

Once Asia’s and the world’s largest outbound travel market, China is not showing any signs of relaxing its severe border measures in the short-term. In 2021, international departures from China were just 2% of 2019 levels, according to GlobalData.

Domestic travel has somewhat propped up carriers. According to GlobalData, domestic trips reached 59% of 2019 levels in 2021 – 1.8 billion trips. Domestic travel in China is expected to surpass pre-pandemic levels at 3.2 billion domestic trips in 2022, representing 101% of 2019 levels.

However, this hasn’t been enough to stem losses, and lockdowns in places such as Shanghai and Shenzhen, as well as in tourist hotspots like Sanya, are major deterrents to even domestic travel. The pandemic has also altered Chinese domestic tourism as consumers are now more likely to favor local and shorter trips amid the pandemic, reducing the need for domestic air travel.

Continued losses for China’s Big Three state-owned carriers

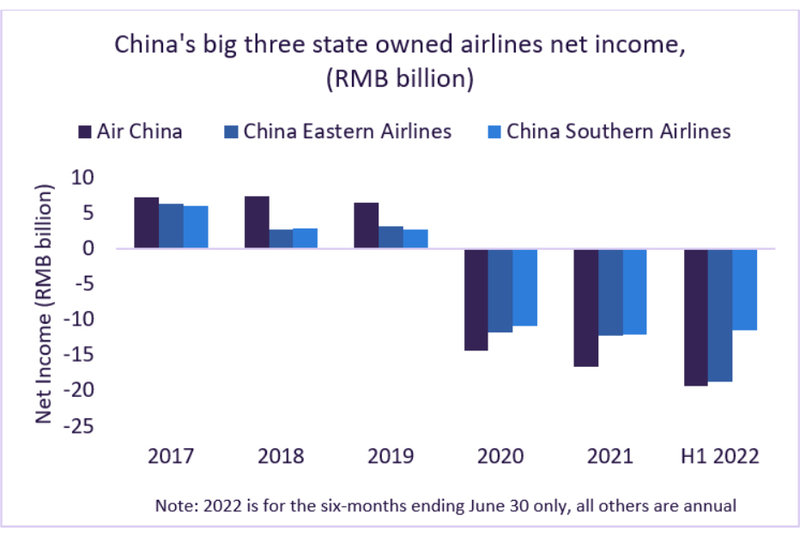

As China has not relented with its zero-tolerance strategy of border restrictions and lockdowns, the country’s big three state-owned airlines saw total combined losses rocket to RMB127.6bn ($18.4bnn) for the period January 2020 to the end of June 2022.

Air China reported a net loss of RMB19.4bn ($2.8bn) in the first six months of 2022, an increase of 187% from the same period in 2021. Similarly, China Southern Airlines reported a deficit of RMB11.5bn ($1.7bn). Meanwhile, China Eastern Airlines detailed a net loss of RMB18.7bn ($2.7bn).

Air China blamed losses on restrictions on the capacity input in international routes. In a press release from March 2022, Air China also pointed to rising oil prices and exchange rate fluctuations (i.e., a weaker yuan) hampering performance.

China Southern also cited increasing jet fuel costs, a fall in passenger revenue from domestic travel and missed peak travel seasons, the Spring Festival and Summer.

China Eastern has been particularly badly hit by lockdowns in Shanghai, where it is based. Its net loss reached RMB10.9bn ($1.6bn) in the second quarter of 2022, higher than the RMB7.8bn ($1.1bn) loss in the first quarter, primarily due to lockdowns in its home city. The airline also had to deal with a fatal disaster in March 2022.

Tensions with the US compounding Covid-19 problems

Disputes with the US over Beijing’s strict policies when travelers test positive for Covid-19 are also hindering recovery.

Tensions have resulted in the US suspending 26 China-bound flights in August and September from the US by four Chinese carriers, including the big three, after the Chinese government suspended some US flights because of Covid-19 restrictions. This follows the 44 China-bound flights that were suspended in January.

Chinese carriers will undeniably continue to struggle until domestic and international travel return to something like normality.