UKRAINE CRISIS BRIEFING

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 8 April

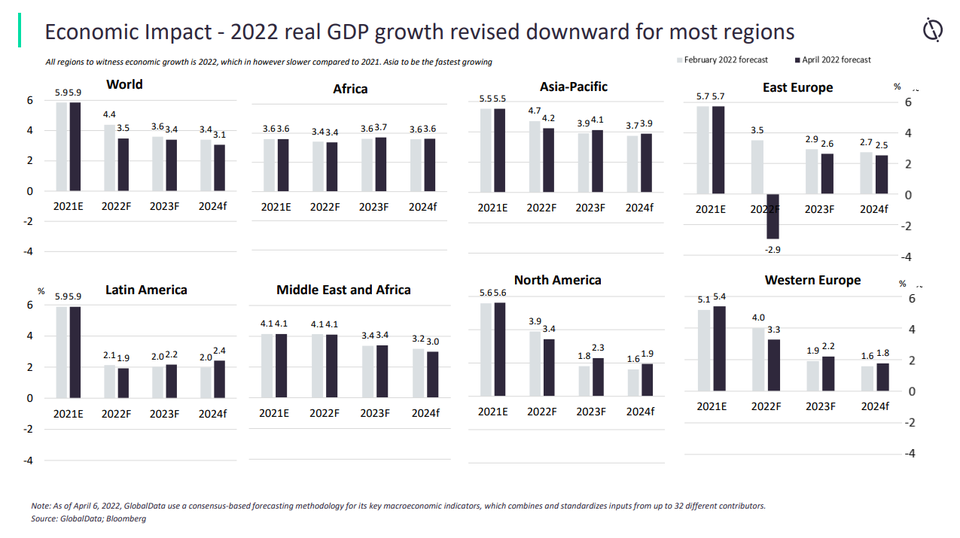

GlobalData forecasts that the world economy will grow at a slower pace of 3.8% in 2022 following a 5.9% growth in 2021. Global inflation is projected to rise to 6% in 2022, from 3.5% last year, due to supply chain disruption amid the Ukraine-Russia war.

Following Russia's invasion of Ukraine, oil and natural gas prices skyrocketed and put pressure on the already high inflation rate. GlobalData revised its real GDP growth forecast downward.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 8 April

Revenue impact

Airlines across the globe will continue to be financially impacted by the crisis for as long as it continues. The EU and the UK have already imposed a blanket travel ban on Russian aircraft using their airspace, and Russia has responded with like for like restrictions.

Many European airlines will now have to take longer routes to avoid flying over Russia. This requires more fuel, the price of which has become incredibly difficult to predict.

Oil prices have surged, and look set for a period of volatility, making cost management extremely difficult. Air France-KLM stated that the outbreak of a full-scale conflict would put tremendous pressure on oil prices and will likely disrupt the group’s plans for recovery this year.

Wizz Air slashed its growth target in March after stopping the sale of flights to and from Russia and Ukraine as the conflict between the two countries continues. Wizz Air is the only EU carrier to have a base in Ukraine.

The company’s four aircraft stationed there will be withdrawn pending a “safe evacuation window” for them. It previously operated 45 routes out of Ukraine and was the second-largest budget airline in the country with a 27% market share, according to the company’s 2021 annual report.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Key Travel And Tourism developments

SANCTIONS

Due to sanctions, Russia’s flagship airline Aeroflot has announced the halt of all its international flights, except to Belarus, and the country’s second-biggest airline, S7, has also suspended its international flights.

Many non-Russian airlines are having to take diversions to avoid flying through Russian airspace. Closed airspace translates to longer flight times, increased fuel usage, more pilot hours, higher costs, and consequently higher fares. Higher fares could further impact the recovery of many airlines with global operations.

Cathay Pacific has planned the world’s longest passenger flight by rerouting its New York to Hong Kong service over the Atlantic to avoid Russian airspace.

DEMAND DISRUPTION

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Ukraine and Russia are important source markets for Turkey. In 2021, they created a combined 4.9 million visits to Turkey, which was 36% of the total visits from its top 10 inbound source markets. Turkey will be heavily impacted by the crisis.

Russians looking to travel to Europe are faced with unaffordable prices for their airline tickets, with many having to take complicated transfers. This will harm several touristic destinations that are favoured by Russian tourists.