Retail

Going online:

a saving grace for airport retail?

Airport retail relies heavily on passenger footfall, which has all but disappeared during the Covid-19 pandemic. Frances Marcellin assesses the impact of the crisis on airport retail, and asks whether now is a good time for airports to reassess their online offering.

In 2019 there were 4.54 billion scheduled passengers worldwide. Analysts expected 2020 to set a new record of over 4.72 billion passengers, but instead, the coronavirus pandemic spread across the globe, practically bringing international travel to a standstill.

Airports Council International (ACI) estimates that around 50% of passenger traffic will be lost in 2020. As a direct relationship exists between passenger numbers and airport revenue, the ACI predicts that over the course of the year, the airport retail market will also drop by over half in some regions. Dufry, the world’s biggest airport retailer, reported that April 2020’s sales had dropped by 94% compared to the previous April.

The global lockdown has resulted in massive revenue shortfalls, which has meant that airports are operating at a significant loss,” explains ACI director of economics Patrick Lucas, who says that retail and food and beverage outlets bring in around one-third of an airport’s commercial revenues.

“It is a situation where you have high fixed costs that remain constant, irrespective of a shutdown or downturn, and the consequence is that the industry is threatened in terms of liquidity and solvency,” he continues. “We have already seen credit rating downgrades by Moody’s, Standard and Poor’s and Fitch on airport debt.”

Marie Driscoll is the managing director of luxury and fashion at Coresight Research. Image: Coresight

While online shopping brought in $3.5tn worldwide in 2019, online retail sales accounted for 14% of all retail sales worldwide. With e-retail sales expected to claim 22% of the market share by 2023, the Covid-19 pandemic could be a catalyst for airports to create or improve an e-commerce platform – as Coresight research shows, airport retail sales increased by 9.3% year over year in 2018.

“As we see the sales results for retailers during the quarantine, online sales are growing exponentially while store sales are nil, albeit the store inventory is often used to fulfil online orders,” says Marie Driscoll, managing director of luxury and fashion at Coresight Research. “Currently, in the absence of international air travel, any revenue is something.”

Lucas says the crisis means airports have not got the budget to invest in e-commerce projects, but Brisbane Airport found a way to launch a new shopping channel.

Image:

Brisbane Airport creates BNE Marketplace

When international traffic started decreasing at Brisbane Airport, the retail marketing team acted quickly to create BNE Marketplace, an online shopping channel. It took just 16 days. The site currently has 3,000 products from two of the airport’s retail partners, with six to join soon, but has been designed so all Brisbane Airport’s retailers can participate.

“The BNE Marketplace was set up because Brisbane Airport’s retailer partners needed help – with a drop of more than 96% in traffic, with little time to react, that’s not hard to understand,” says Martin Ryan, executive general manager for the consumers division at Brisbane Airport Corporation.

Martin Ryan is the executive general manager for the consumers division at Brisbane Airport. Image: Brisbane Airport Corporation

They managed to build the product so quickly by partnering with Shopify and maximising the use of internal skills. “The speed was a combination of right platform and skills applied in a way that felt more like a start-up vs a large organisation,” says Ryan.

Image: Brisbane Airport / Jen Dainer

“Money goes directly into keeping as many of our partner’s staff employed in the short term (and hopefully the longer term as well if we can get sufficient volumes),” he says. “The prices are extremely competitive and shipping is really quick so it is not like there are any concessions – it might not be the first place you’d think to browse, but there are some cracking deals.”

The speed was a combination of right platform and skills applied in a way that felt more like a start-up vs a large organisation

How can airport e-commerce be competitive?

Accessible to everyone, the challenge is how airport retailers can make themselves competitive when there are so many successful online outlets. Amazon’s net sales, for example, increased by 26% to $75.5bn in the first quarter of 2020 compared with $59.7bn in 2019.

“Online players such as Amazon and Alibaba, with their strong global presence, have become direct competitors for travel retailers,” states AOE’s (a travel retail digitalisation company) whitepaper Digital Airport Commerce.

As shopper behaviour has moved away from just impulse buying, planned purchases become more important. “The share of pre-planned purchases is even higher than the share for all customers, (71%, with only 29% being impulse purchases),” reads the report.

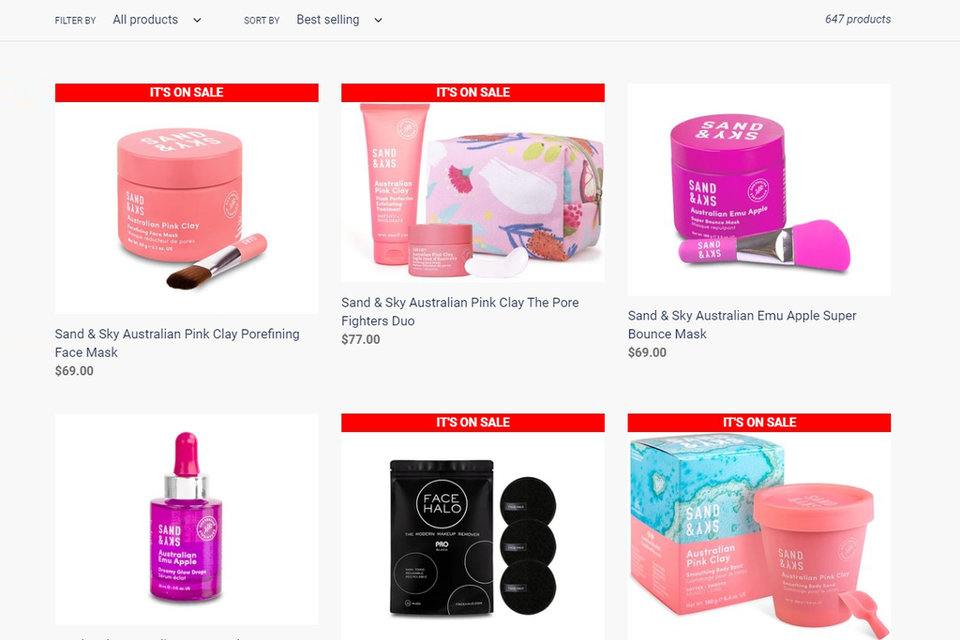

Driscoll says that airport retailers can make themselves competitive by having products not easily acquired elsewhere, as well as creating their own exclusive product and collaborations.

BNE Marketplace has 3,000 products. Image: Brisbane Airport

Non-airport online marketplace Etsy saw 100% growth in April. Etsy chief executive officer Josh Silverman says that the team reacted quickly to address the surge in demand for cloth face masks, which included “creation of on-site banners and automated filters, scaling inventory with a call to action for sellers, retraining our search algorithms, and managing delivery expectations”. Among other strategies, Etsy also launched a #StandWithSmall campaign in support of independent businesses.

He adds: “Our strong performance is thanks to a combination of macro dynamics and Etsy’s agility to pivot to meet market demands.”

Etsy’s fast reaction to the pandemic shows how thoughtful merchandising can increase sales.

“With thoughtful merchandising and offering international products not easily accessible otherwise, airport marketplaces could become destinations for discriminating shoppers,” says Driscoll.

Airport marketplaces could become destinations for discriminating shoppers

Frankfurt Airport’s award-winning e-commerce platform

Frankfurt Airport is the fourth busiest in Europe, serving 70 million passengers in 2019. The airport gained 10 million passengers over the last three years and, by partnering with Magento Commerce Partner AOE, built an award-winning e-commerce platform over the course of one year. The platform now attracts millions of consumers annually.

“Having an online marketplace is an important aspect of our multichannel retail experience and [it is] a significant service for Frankfurt Airport as an international hub,” says Fraport spokesperson Angelika Heinbuch.

Usually, passengers with a flight ticket can purchase items three months before departure, but during the coronavirus lockdown these restrictions were lifted as the airport suffered a 95% traffic decline in April.

The flipboard at Frankfurt Airport, Germany. Image: Markus Mainka / Shutterstock.com

Product reservations and home delivery options are available to passengers. However, traffic to the marketplace has always been a minority compared to the physical stores.

“That proportion never changed during the crisis,” says Heinbuch. “It primarily serves the goal of a consistent omnichannel shopping experience and gives customers the opportunity to shop in the way they personally prefer,” she adds.

Having an online marketplace is an important aspect of our multichannel retail experience

E-commerce solutions to boost falling spend per passenger

At the 2018 Summit of the Americas conference, AOE CEO and founder Kian T Gould’s presentation showed that while the travel retail market has been growing – from $63bn in 2014 to $67bn in 2017 – travel spend per passenger is dropping. Figures show an overall decline from $19 per person in 2014 to $16 in 2018, but Gould points out that the same passengers also spent $540 online and $6,030 in retail.

He says that “webrooming” is more profitable than showrooming, claiming that every 100,000 unique visitors to the site increases physical sales by €500k-€750k.

Driscoll says that as consumers are already using apps to make purchases (such as Nike and Starbucks), airports should jump on the bandwagon. “In an airport where time can be limited, using an app to make a purchase and have it delivered to the gate is a valuable service,” she says. “Atyourgate is an airport app that delivers food and products to the gate.” So far, Atyourgate is available in ten American airports, including JKF International.

Coresight’s report says that shoppers have around 56 minutes of free time before boarding so spend around 25 minutes shopping at duty-free stores. Watches, jewellery and fashion are the most popular as prices are duty free and “typically lower than in regular retail stores”. In addition, having a range of products that can be purchased, collected and delivered could be more likely to boost spend per passenger.

AOE identified in its whitepaper – based on a study of 50,000 passengers by travel research agency m1nd-set – that ‘reserve and collect’ conversion numbers have been “underwhelming”, with reservations and collections of perfumes, cosmetics and alcohol at below 50%.

The paper suggests that online payment options, more advertising around services and offering a broader range of products could improve results. AOE asks in its white paper: “Why would passengers reserve products that they can buy spontaneously at the airport?”

In an airport where time can be limited, using an app to make a purchase and have it delivered to the gate is a valuable service

Heathrow’s product expansion drives spend per passenger increase

Heathrow Airport handled 80 million passengers in 2019, and by improving its retail offering and introducing an omnichannel e-commerce platform, also built with AOE, has increased its retail revenue each year overall. Average passenger spend has increased from £6.37 in 2013 to £8.93 in 2019.

AOE reports that replacing the existing reserve and collect system with a digital marketplace – which combines flight information, shopping and airport services on one platform – caused the average shopping basket to increase in value five times. Previously featuring a limited number of products, the new range at launch had increased by ten.

Heathrow Airport. Image: Fasttailwind / Shutterstock.com

Today “the number of integrated retailers and products on offer is unlimited”, according to AOE, as retailers themselves control what products are sold on the scalable online platform.

In terms of how much airport retailers can expect to increase sales with an attractive online e-commerce site, Kevin Zajax, CEO of Ground Control (industry experts in F&B and airport retailing), says that e-commerce in mainstream retail is around 15%-16%.

Retailers themselves control what products are sold on the scalable online platform

No choice but to build e-commerce sites

Zajax suggests that only 20% of passengers consume food and drink, or purchase retail on their airport journey. He says this figure is based on a combination of publicly available data, commercial studies and industry insight. Before the coronavirus, he believed the industry could grow by making efforts to attract the other 80%, but now he says the problem is more to do with how travel retailers sustain a “one in five capture rate”.

“Given the already declining trend in capture rates, and the new challenges ([including] social distancing [and] contact points) Covid-19 throws into the mix, retailers have no choice other than building and making available an attractive online e-commerce site,” he says.

Retailers have no choice other than to make available an attractive online e-commerce site