Coronavirus (Covid-19) Executive Briefing

Understanding the economic impact of the Covid-19 pandemic and the implications for the travel and tourism sector

- ECONOMIC IMPACT -

Economists and institutions have cut their forecasts and experts are predicting the potential onset of recessionary environments.

According to the International Labor Organization (ILO), more than one in six young people worldwide have stopped working since the Covid-19 outbreak. (29 May)

$8.5tn

Global economic output will fall by $8.5tn over next two years, according to the UN’s World Economic Situation and Prospects report. (13 May)

-4.9%

IMF predictions: global growth will decline by 4.9% in 2020. Chinese and Indian economies will grow by 1% and contract by 4.5%, respectively. (24 June)

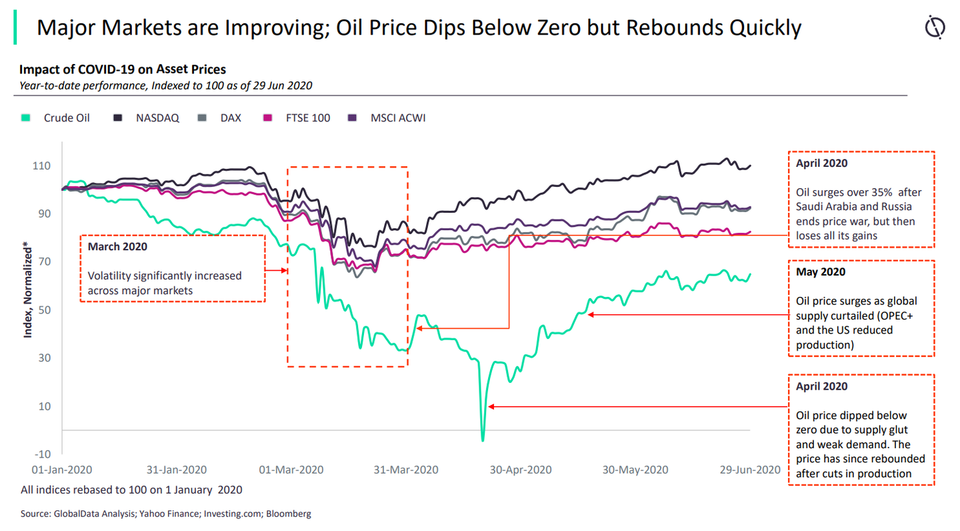

Impact of Covid-19 on asset prices

- SECTOR IMPACT: TRAVEL & TOURISM -

As of 1 July 2020

decrease in passenger traffic

$9.7bn

Lufthansa announced on 25 May that it will receive €9bn ($9.7bn) from the German Government, in exchange for a 20% stake in the firm.

Airlines industry impact

$314bn

IATA’s estimate of lost airline revenue for 2020 now stands at $314bn, a 55% reduction compared to last year.

International air travel impact

-34.5%

GlobalData forecasts that international arrivals into the 62 largest tourism markets globally will fall by 34.5% in 2020.

Key aviation market developments

Air bridges

The UK looks set to establish a series of air bridges with other European nations, which would make short trips more viable. Air bridge talks in other parts of the world, most notably between New Zealand and Australia, are at an advanced stage too.

Airlines are now increasing their flight schedules, both domestically and internationally to create demand during the busy summer months. The number of flights operated remains well below pre-Covid levels but plans to gradually ramp up active routes have now been announced by several major carriers. Norwegian reported greater-than-expected demand and is re-introducing more routes than originally planned.

Despite these positive signs, there remains a great cause for concern. The recent surge in new cases in some US states could see a reintroduction of travel bans. Greece has announced an extension to its ban on UK flights until 15 July. Southwest and Delta are operating with reduced capacity on board to implement social distancing.

Unemployment

British Airways has put 12,000 jobs at risk, while Ryanair and TUI have warned of the potential for 3,000 and 8,000 job losses respectively. On 11 June, Lufthansa announced that it could cut up to 22,000 jobs and on 25 June, Qantas said as many as 6,000 jobs could be lost.

Demand Disruption

A diplomatic spat between the US and China has seen a mutual ban on each other's airlines. Each is a major source market for the other so this will have a significant, negative impact if the problem is not resolved swiftly.