Coronavirus (Covid-19) Executive Briefing

Understanding the economic impact of the Covid-19 pandemic and the implications for the travel and tourism sector

- ECONOMIC IMPACT -

After weeks of gradual decline, GDP estimates for many countries have levelled off. Consensus forecast for world GDP growth in 2020 is -3.9%.

The Eurozone reported record price deflation for the first time since 2016 (1 September). Dun & Bradstreet believes the global economy is unlikely to reach pre-pandemic level output before 2022 (7 September).

-4.4%

Fitch Ratings revised its 2020 forecast for global economic growth to -4.4% from the earlier estimated -4.6% (7 September).

9.7%

The German economy contracted by a record 9.7% in the second quarter, according to the German statistics office (25 August).

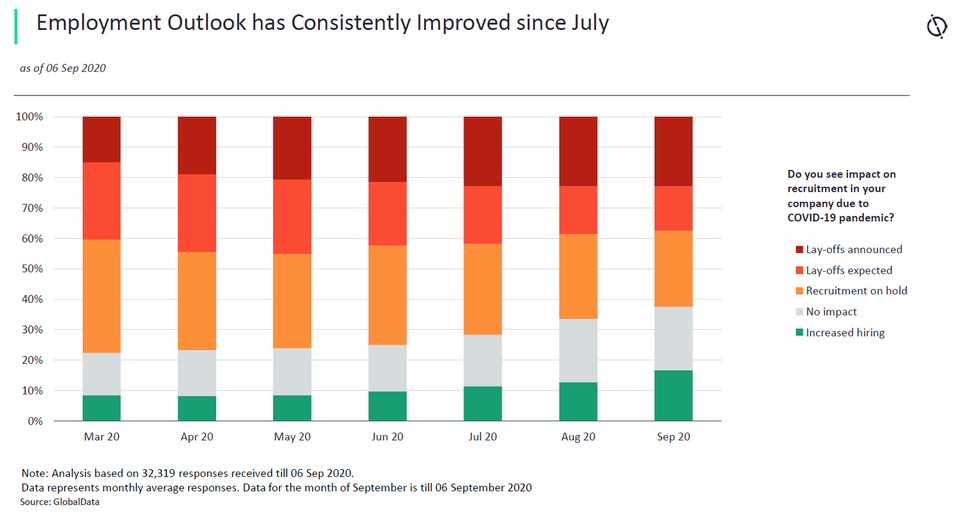

Covid-19: Employment Outlook

- SECTOR IMPACT: TRAVEL & TOURISM -

As of 26 August 2020

decrease in airline revenues

$11bn

Airlines continue to struggle. Delta registered a $3.9bn adjusted pre-tax loss for the June quarter as revenues fell by more than $11bn compared to last year.

Further Job Losses

900/500

Job losses are announced with increasing regularity. Hays Travel has put 900 jobs at risk, while STA's demise is expected to cost 500 jobs in the UK.

Changes to CARES ACT funding

1 October

Swissport, Menzies Aviation, WFS and dnata have all warned of potential job cuts as airports continue to see reduced traffic and the airline industry awaits 1 October with bated breath as terms forbidding job cuts attached to CARES Act funding expire.

Key travel market developments

The travel and tourism industry has so far not seen the kind of turnaround it was hoping for in the early stages of H2. The busy holiday period initially offered great hope, but confusion over ever-changing travel corridors and increasing infection rates in Europe have checked momentum.

Airlines had originally started to increase capacity, but in light of reduced demand, Ryanair has announced it is scaling back capacity in September and October. easyJet has pulled out of three UK hubs, while Southwest airlines has announced a significant pullback of flights in October.

The recent surge in new cases in Europe has led to significant changes with regards to travel corridors and the UK's decision to impose quarantine on arrivals from Spain, France and Croatia has heaped more pain on operators.

Despite all the gloom surrounding the industry at present, Airbnb last week submitted a draft registration to the Securities and Exchange Commission for an initial public offering. Many are predicting a blockbuster IPO as the short-term rental market bounces back quicker than traditional hotels thanks to its natural lean towards social distancing.