Feature

Boeing pleads guilty. What next for its government contracts?

Following Boeing's guilty plea to fatal 737 MAX crashes, the DoD initiated talks over the prime’s lucrative government contracts. Alex Blair investigates

Boeing CEO Dave Calhoun during a Senate Homeland Security and Governmental Affairs Investigations Subcommittee hearing. Credit: Andrew Harnik/Getty Images

Boeing is almost certainly too big to fail – but the plane-making giant is not exempt from a Department of Defense (DoD) scolding, severe reputational damage, or exclusion from lucrative government contracts in future.

Minutes before a midnight deadline on Sunday 7 July, Boeing made a legal filing to accept the US Department of Justice’s (DoJ) plea deal for charges relating to the fatal plane crashes of its 737 MAX aircraft in 2018 and 2019. These crashes, blamed on flawed flight control software, killed 346 people in Indonesia and Ethiopia.

The plea deal came as Boeing attempts to weather a maelstrom of widely publicised aircraft issues, damning reports into quality control and various government investigations following the accusations of whistleblowers, two of whom have since died.

All of the above leaves the company, one of the US ‘Big Five’ defence primes regularly selected for US Air Force contracts, in severe turbulence.

As the DoD initiates talks with Boeing over how its planned guilty plea will affect its extensive and lucrative government contracts, the question remains: will the US government throw Boeing a lifeline?

The DoD and Boeing: an unshakeable co-dependence

In 2023, a reported 37% of Boeing’s revenue came from the US government, including foreign military sales. A government report said Boeing had $14.8bn in Pentagon contracts in 2022.

The majority are fixed-price contracts, from the $7.4bn deal for Boeing to manufacture Joint Direct Attack Munition (JDAM) tail and sensor kits, to a $559m, five-year contract to continue running the US Air Force’s nuclear missile test facility in Utah.

Amid intensifying geopolitical pressures from the Korean Peninsula, Ukraine, to the Middle East, demand for arms supply has increased. Admittedly, the DoD could turn to Lockheed Martin, RTX or any other major manufacturer, but Boeing holds a uniquely strong position in the fabric of the US military-industrial complex.

As with many primes, Boeing is awarded a lot of work on its own platforms – work that only Boeing can undertake, under non-competitive, sole-source acquisition. This means the company is assured of a steady stream of revenue.

The unlikely scenario of Boeing losing government contracts is dependent on top officials receiving suspensions or criminal convictions, but Pentagon agencies generally have the power to grant exceptions.

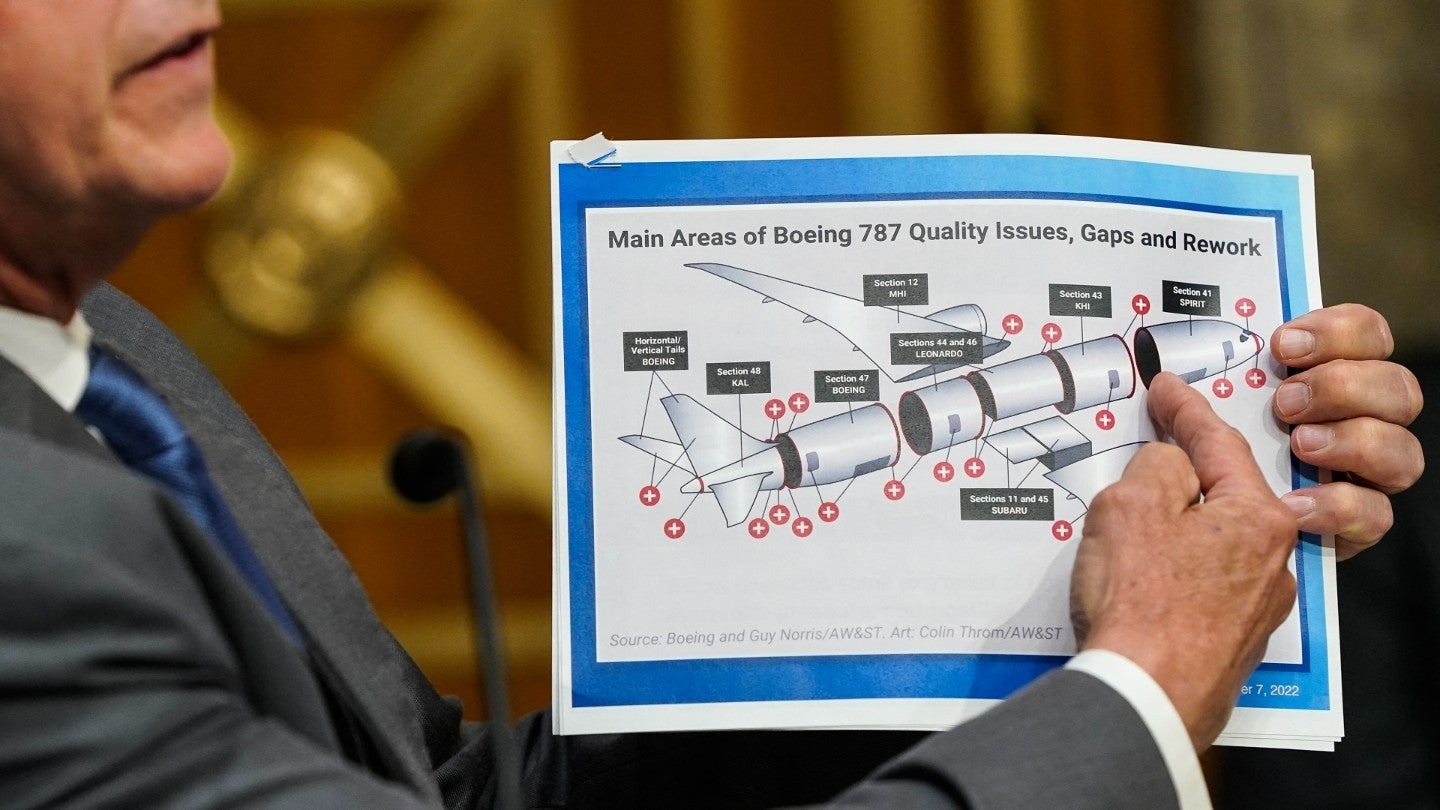

US Republican Senator Roger Marshall holds up a diagram illustrating quality issues with Boeing 787 planes during a US Senate hearing examining boeing’s broken safety culture. Credit: Drew Angerer/Getty Images

As Boeing’s top brass waits for the US government’s verdict, the “Department of Justice had advised the DoD, including the Department of the Air Force, about this matter”, a defence official from the DoD tells Airport Industry Review.

“The Department of Defense will assess the company’s remediation plans and agreement with the Department of Justice to make a determination as to what steps are necessary and appropriate to protect the federal government,” the official adds.

As a “litigation matter”, the DoD also referred Airport Industry Review to the Department of Justice (DoJ). The DoJ and DoD have lightly criticised Boeing but urged the company to accept a plea deal and avoid criminal convictions, implying both agencies’ intention to put Boeing back on course.

Boeing did not respond when approached for comment.

More of the same ‘sweetheart deal’?

Boeing’s plea deal would see it enter a guilty plea of conspiring to defraud the US government in its probe of the 737 crashes. The aircraft manufacturer would have to pay a penalty of $487.2bn.

But the deal is not yet confirmed, as it depends on the decision of US District Judge Reed O’Connor in Ford Worth Texas. O’Connor may reject the agreement – a far from uncommon outcome in deals between the defendant and federal government, which judges often feel usurp their power.

The families of 346 crash victims, who will meet Boeing’s board of directors if the agreement is finalised, have criticised it as a ‘sweetheart deal’. Preferential treatment is to be expected, according to Andrew Charlton, managing director of government transport consultancy Aviation Advocacy.

“It is very hard to believe that Boeing and the DoD will not negotiate a waiver or exemption to allow it to continue to provide kit,” Charlton tells Airport Industry Review. “It would be impossible for ongoing contracts to be performed and we are very close to that most complex of outcomes ‘too big to fail’ in defence”.

Rescue teams collect the remains of bodies in debris at the crash site of Ethiopia Airlines near Bishoftu, a town 60km southeast of Addis Ababa. 149 passengers and eight crew members were believed to have died after an Ethiopian Airlines Boeing 737 crashed en route from Addis Ababa to Nairobi. Credit: Michale Tewelde/Getty Images

Boeing wears two hats – and it is the second hat where the manufacturing giant’s revenues may suffer most.

Boeing’s Defense and Space Unit is vital to the company’s overall business and is mostly propped up by military contracts, but the Boeing Commercial Airplanes division is far more influenced by the competitive civil aviation market.

As international trust in the company seems to dwindle daily, competition may prove to be a spanner in the works. Boeing Commercial Airplanes remains the second largest aerospace company in the world – but its crown was usurped by arch-rival Airbus in 2019 after the fatal 737 grounding in Ethiopia.

“In PR terms it is a disaster, but better than any other possible outcomes (i.e. going to court and having all this stuff made public),” Charlton concludes. “It will clearly mean that Boeing has another hurdle to overcome when bidding and, I suspect, costs to pay in terms of auditing and providing background and data to potential and existing customers. Maybe it also throws a light on the position Airbus is in, and do we need to find a way to ensure that it has competitive pressures on it?”

All eyes now turn to the outcome of the DoD’s talks with Boeing. Will it be a mere slap on the wrist and offer to support the US prime through the storm, or a strong reprimand in line with the suffering and loss caused by the company’s carelessness?